Holding corporations accountable

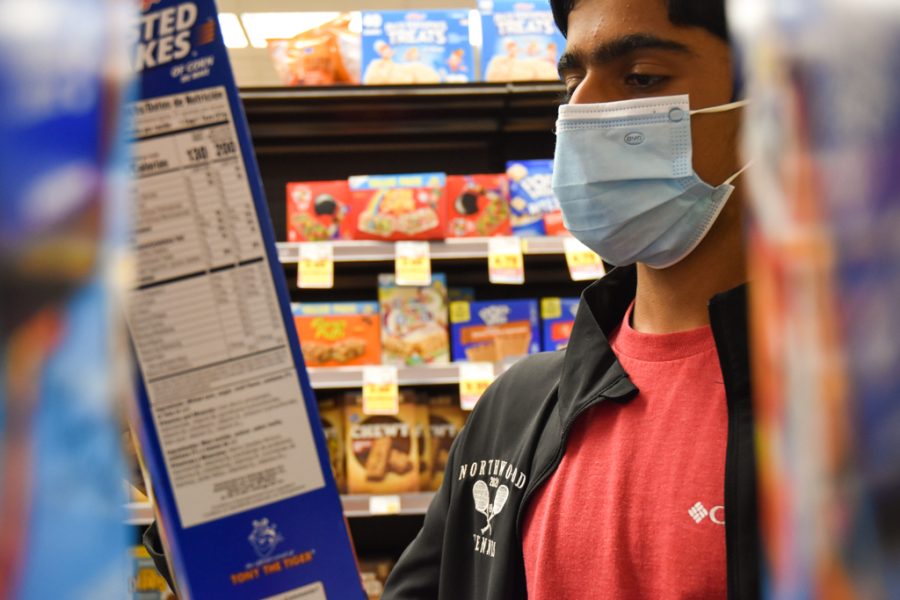

NO SUGARCOATING IT: Junior Omair Rana scans a box of Frosted Flakes, noting the significant price increase of the product.

March 14, 2022

Imagine walking into the grocery store hoping to buy a box of Frosted Mini Wheats only to discover the price increased from $3.50 to $4. Although the difference seems small, these price increases accumulate as multitudes of companies raise their prices due to claimed inflation, and eventually, even weekly essentials at the grocery stores become unaffordable.

This is the reality faced by many American families, some just barely scraping by. But in reality, it’s not inflation that’s raising prices—it’s corporate greed. Here’s some food for thought on how manufactured claims of inflation manifest in The Kellogg Company, one of America’s leading snack producers.

Kellogg Co.—owner of Pringles, Rice Krispies and Frosted Mini Wheats among many others—saw record profits during 2021, the quarterly Kellogg earnings report listing $3.42 billion dollars in profit beating previous estimates.

Despite the record profits and rise in share prices, Kellogg CEO Steve Cahillane, in a CNBC interview, stated that the company would be raising prices in response to the supply chain crisis, workers’ strike and inflation that had occurred in 2021.

Let’s break down the issues of supply chains, worker’s strike and inflation to show that this argument has no legs to stand on.

While the supply chain issues may have caused disruptions to companies, leading to the need to raise prices to offset the interference, the disruptions do not excuse the degree to which companies raised their prices, with the U.S. Bureau of Labor statistics reporting a 6.5% increase in cost for food. The supply chain issue is set to cost large companies about $184 million yet a price increase of 6.5% in 2021 is set to increase Kellogg’s earnings over $200 million.

Kellogg also had a worker strike over its proposed two tier wage system that shut down four factories for three months. Kellogg hired temporary workers to keep the plants running at a higher cost, before eventually agreeing to remove the wage system and giving workers a raise of $1.10. This increase of labor cost at these four factories was negligible, especially in light of Kellogg’s record profits.

Instead, it is the claim of inflation that is actually driving inflation. Kellogg, mirroring other companies like Starbucks, is using inflation as an excuse to raise prices. Companies reported record profits as people continued to buy products at a higher rate than before the pandemic. Yet as lockdown restrictions eased, and consumers switched from buying products to services, companies sensed an impending reduction in revenue and decided to raise prices, driving inflation up to the 7.5% it is today.

When consumers purchase necessities at increased prices, companies see demand for their goods. Whether it’s $3.50 or $4, people will still buy cereal, toilet paper and other necessities. The only purpose for a company reporting record profits to continue to raise prices is to fatten their bottom line.

It’s time to stop the squeeze on consumers by greedy corporations. Elected officials must pass antitrust laws to prevent companies from raising prices to absurd levels, prohibiting price-fixing and price discrimination.

It’s no longer permissible to let corporate greed be the norm.

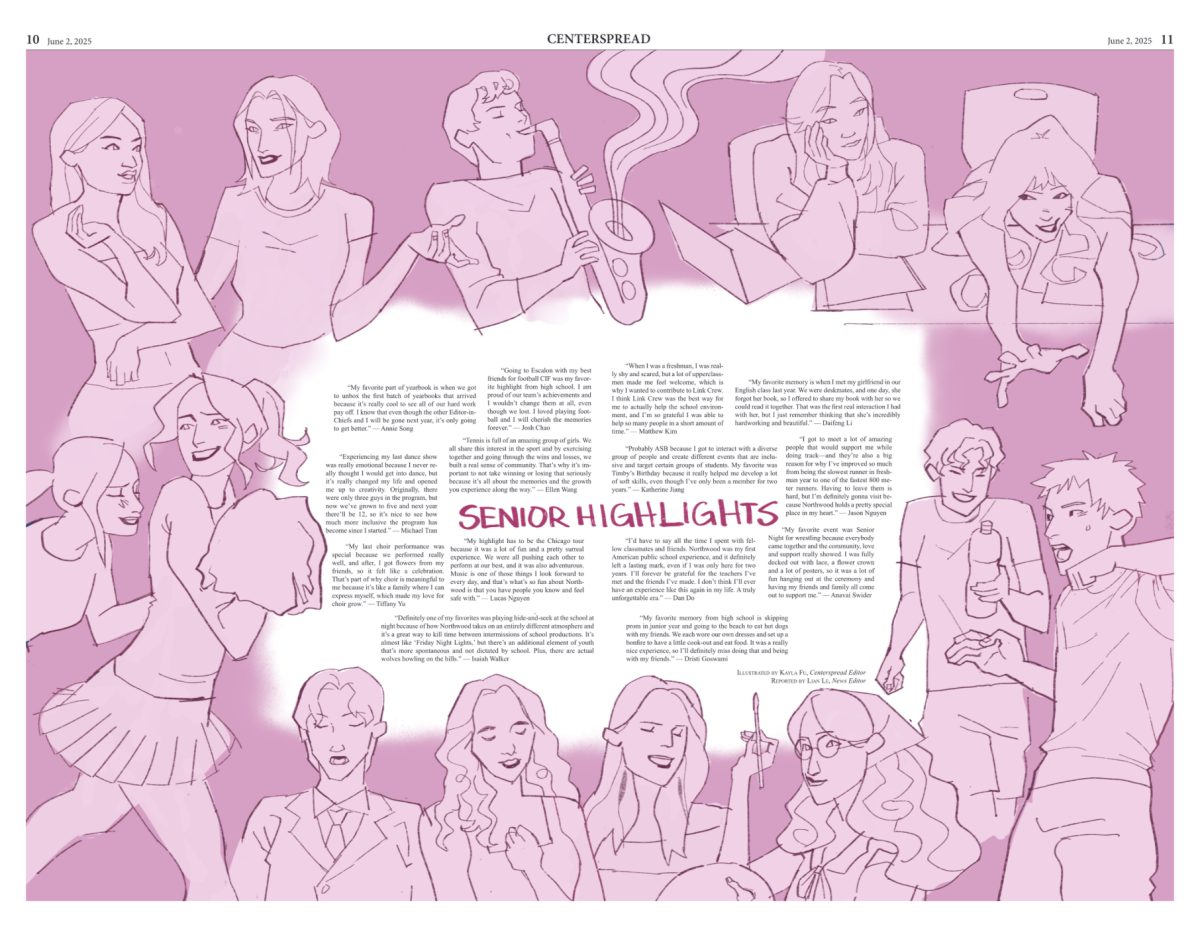

![AAAAAND ANOTHER THING: [CENSORED] [REDACTED] [BABY SCREAMING] [SIRENS] [SILENCE].](https://thehowleronline.org/wp-content/uploads/2025/06/lucy-1200x800.jpg)

![AAAAAND ANOTHER THING: [CENSORED] [REDACTED] [BABY SCREAMING] [SIRENS] [SILENCE].](https://thehowleronline.org/wp-content/uploads/2025/06/lucy-300x200.jpg)