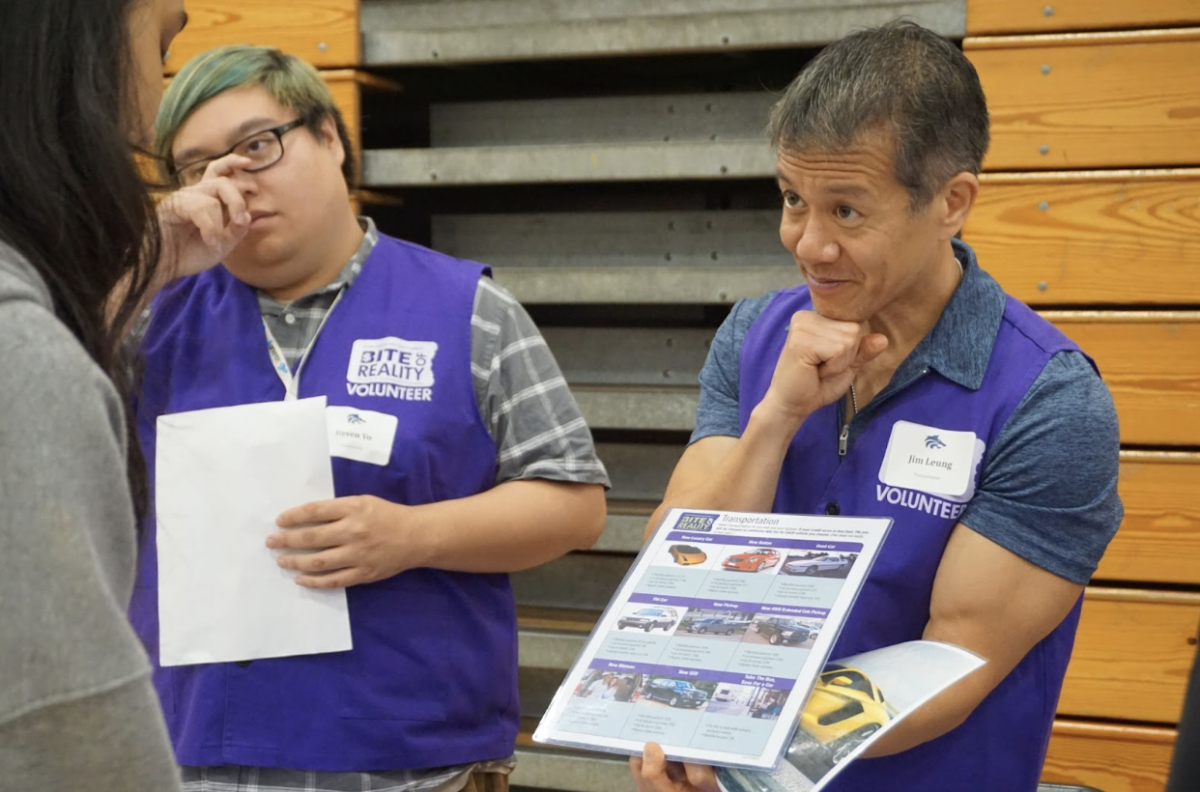

Northwood seniors gathered in the gym on Oct. 25 to engage in “Bite of Reality,” an interactive budgeting simulation designed to mimic various financial scenarios that participants may encounter in their adult lives.

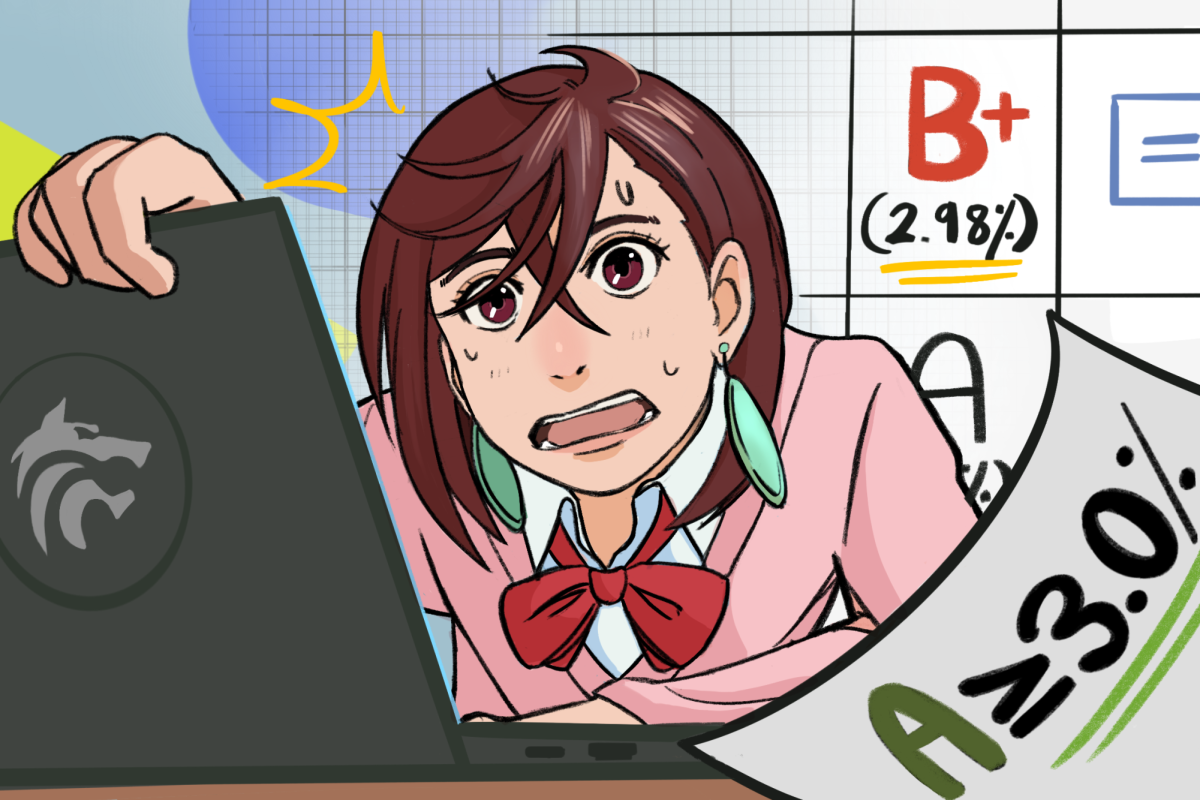

Through the app, students were given a persona—completed with information regarding their occupation, spouse, children, income and unpaid debt—and were then instructed to use their monthly budget to plan their family spending. SchoolsFirst Federal Credit Union employees and teacher volunteers led students throughout this budgeting experience.

“Through the simulation, students can get a feel for what purchases are necessary,” SchoolsFirst Federal Credit Union employee Bo Rodriguez said. “We bring people from our credit union and volunteers from the community and coach them to sell the most expensive thing to mimic real-world sales associates.”

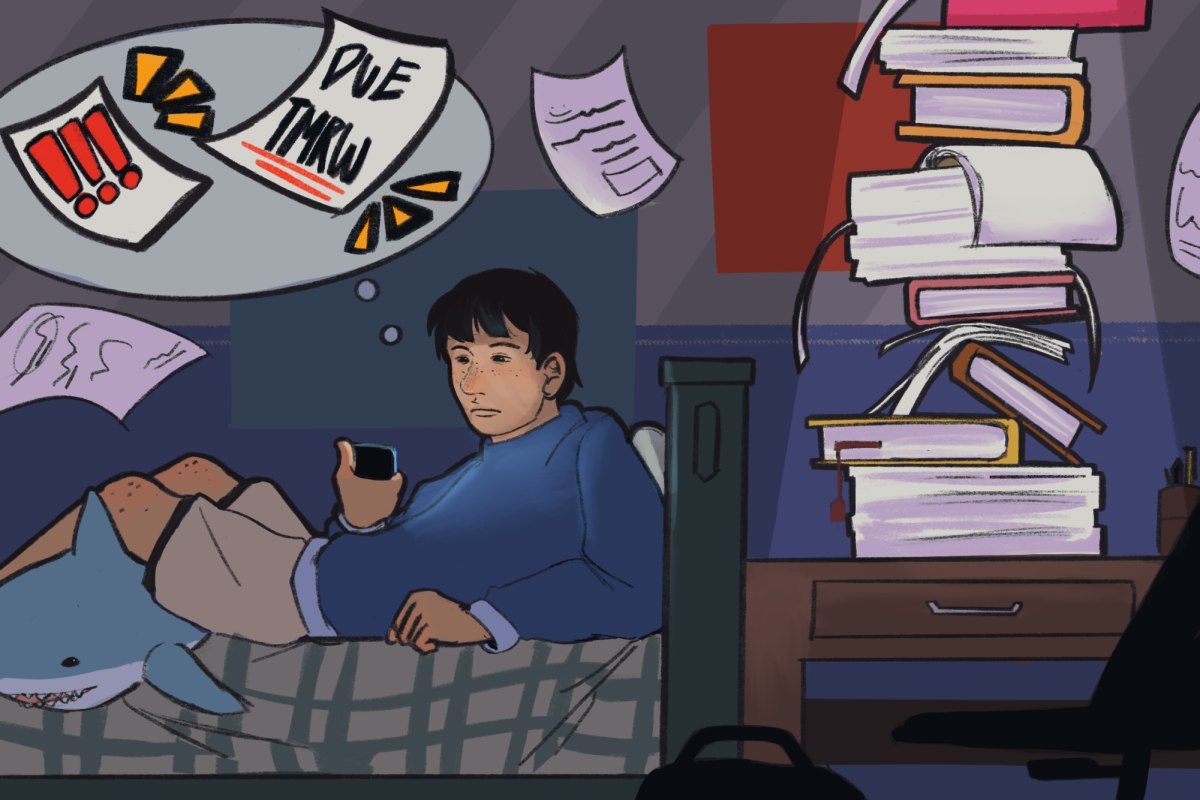

Eight different stations were set up to mimic crucial areas of spending: transportation, housing, groceries, entertainment, household needs, clothing, shopping and child care. Throughout the simulation, students received “bites of reality,” which were random events that would impact the student’s budget, such as unexpected medical emergencies requiring medical payments or garage sales that gave students an extra boost of finances.

“There were these random moments where we were given ‘bad luck’ where we would lose money or have to pay our debts to the credit union,” senior Audrey Lee said. “It made me realize how much responsibility it takes to be an adult and function in society knowing you have a certain budget every single month, especially since you can’t hit restart in a real-life situation.”

The event concluded with students sharing their experiences and challenges they faced throughout the simulation, highlighting the importance of allocating money for different aspects of life and being financially prepared for “bad luck” events.

“The sooner you are exposed to budgeting and financial literacy, the better you can be at it in the future,” Rodriguez said. “When you do it with low responsibility, it’s easier to practice and gain that experience because budgeting will be a consistent life skill. We want to start the process and inform students so students are more comfortable working with their financial institution.”