The intersection of Robinhood, Reddit and Wall Street

TO THE MOON: GameStop shares soared over 1,600% at the height of the trading frenzy.

March 22, 2021

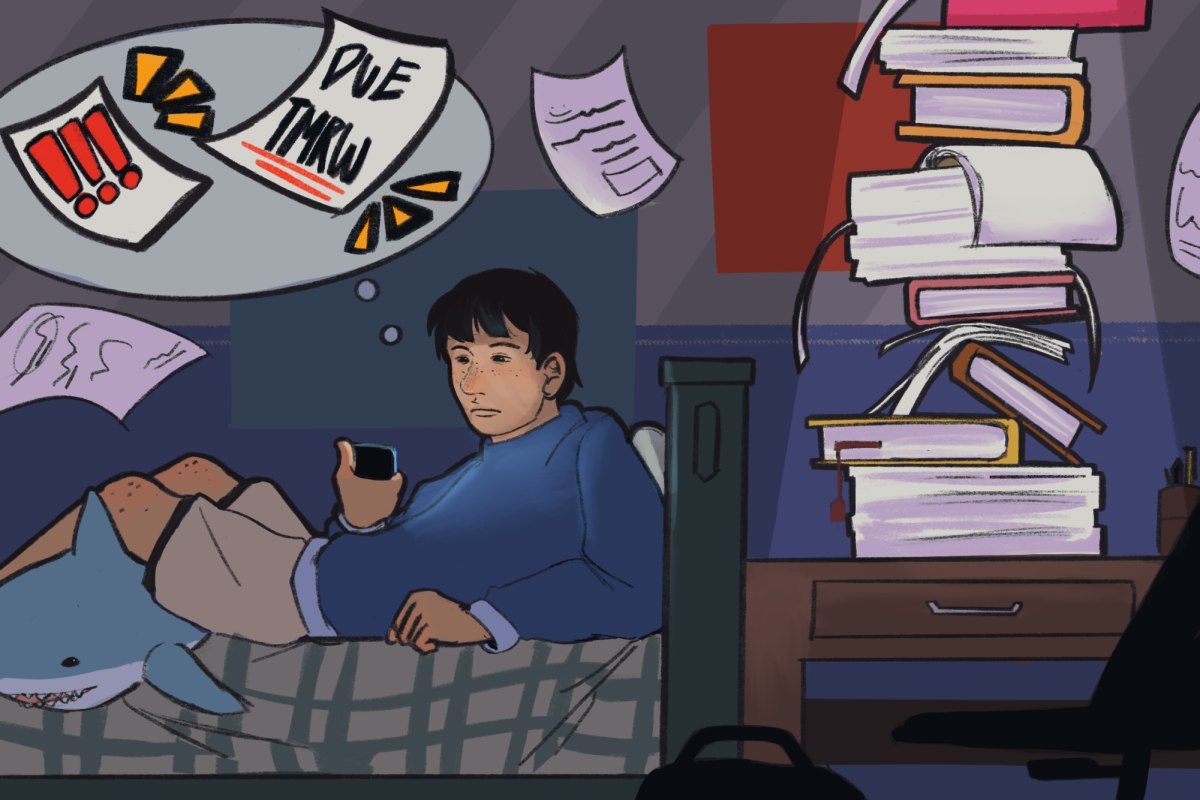

In an Occupy Wall Street-esque movement against financial institutions, the Reddit forum r/WallStreetBets pushed GameStop shares to the moon with a crowd-sourced short squeeze, reaching an all-time high of $483.00 (from its low of $2.57 nine months earlier in April 2020) on Jan. 28. On the same day, Robinhood, a trading app self-proclaimed to be “for the people,” froze trades for GameStop, AMC and Nokia, only allowing the selling of those shares and conveniently preventing further losses for the short-selling hedge funds.

The concept of short selling is simple. Short sellers predict stock prices will drop, so they borrow shares, sell them and hope to later buy the shares back at a lower price, profiting from the difference. If the stock price rises, short sellers are forced to close out their position (buy back the stock at a greater price than they sold it for). Thus, a short squeeze is a rapid jump in a stock’s price, which forces a large number of short sellers to close their position, driving the price up even more.

Last month, GameStop was one of the most shorted of all publicly traded companies along with AMC Theatres, Bed Bath & Beyond and Blockbuster. The circulation of this public information on Reddit began the steady rise of GameStop share prices early in 2020 when r/WallStreetBets posts explained why the stock was undervalued. More posts discussing the possibility of a profitable short squeeze quickly amassed into a week-long rally of retail investors against hedge funds that shorted GameStop, specifically Melvin Capital and Citron Research, which received record losses of nearly $5 billion dollars in 2021.

“We don’t have billionaires to bail us out when we mess up our portfolio risk and a position goes against us,” Reddit user RADIO02118 said in an r/WallStreetBets post titled “An open letter to CNBC.” “We can’t go on TV and make attempts to manipulate millions to take our side of the trade. If we mess up as bad as they did, we’re wiped out.”

Much of this investing was done on Robinhood, an investing app that once prided itself on offering free trades with a goal to democratize America’s financial system. However, in the midst of the GameStop frenzy, the corporation froze trades, citing “market volatility” as its reason for ending the short squeeze momentum.

Consequently, Robinhood received immense backlash, class action lawsuits and a storm of one-star ratings on the Apple and Play Stores (though Apple and Google both deleted thousands of negative reviews), and many political figures on both aisles united to urge an investigation of Robinhood by Congress, including Rep. Alexandria Ocasio-Cortez (D-NY), Donald Trump Jr., Rep. Ro Khanna (D-CA) and Sen. Ted Cruz (R-TX).

The controversy centers around the true motives behind the freeze: Whether it was protecting retail investors for when the bubble would eventually burst, protecting the hedge funds who were still able to freely trade the stock or protecting Robinhood itself from the uncontrollable volume of trade.

Robinhood CEO Vladimir Tenev explained the restrictions were due to insufficient capital to support the high volume of trading, which actually appears to be a legitimate explanation as other brokerage companies like Webull and Interactive Brokers responded similarly. However, regardless of the reason, their actions safeguarded the firm and hedge funds while harming their users.

This event has also shed light on a clear conflict of interest in Robinhood’s business model. The app’s revenue relies on selling users’ trades to market-making firms, revealing the hidden prices beneath Robinhood’s seemingly free platform.

After all, Robinhood works closely with powerful players on Wall Street and in Washington. Robinhood spent $275,000 lobbying the federal government last year in the revolving door between Wall Street regulators and Congress. Meanwhile, to compensate for commission-free trades, Robinhood sells real-time information about which stocks users are buying and selling to large investment firms. This arrangement is known as payment for order flow, where brokers (Robinhood) profit by routing trades to market makers (Citadel Securities). Taking payments for order flow from Wall Street firms is controversial but legal and done by most electronic brokers.

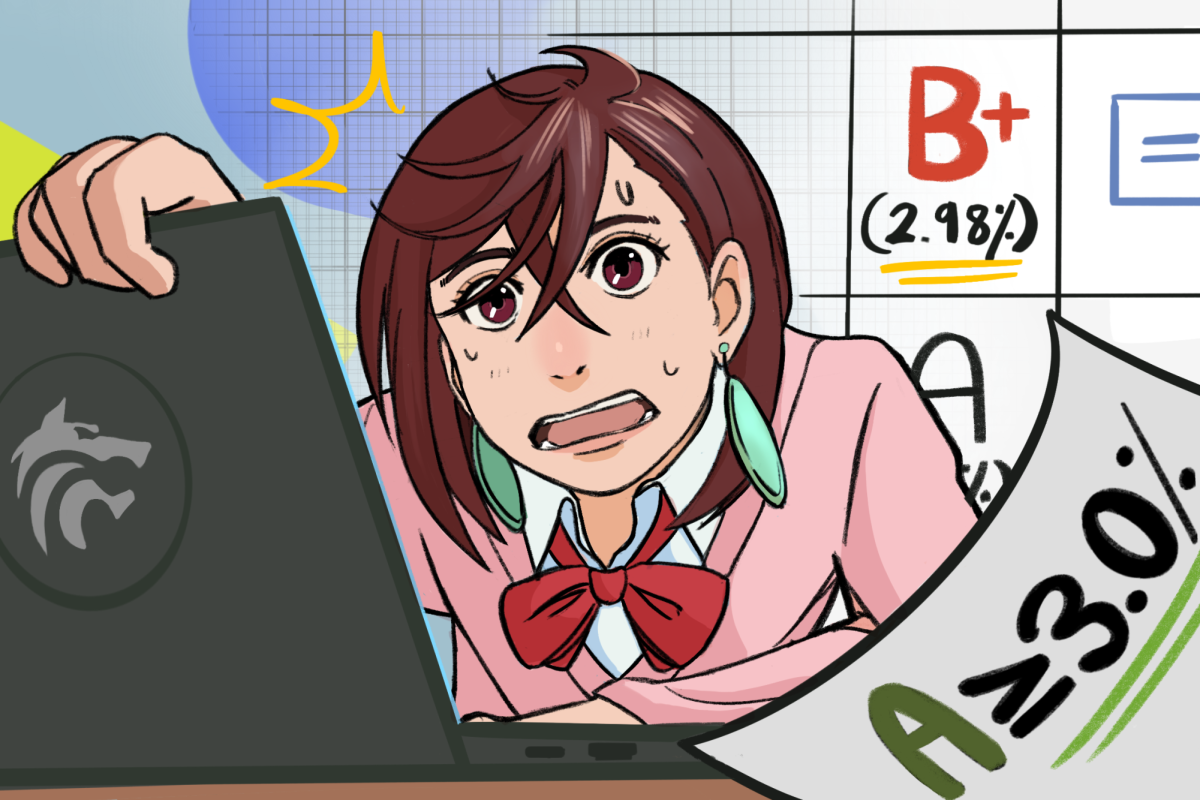

A larger problem at hand is Robinhood’s historic lack of transparency. Last December, the Securities and Exchange Commision (SEC) charged Robinhood with deceiving customers about how it makes money and falsely promising the best execution of trades.

“The order finds that Robinhood provided inferior trade prices that in aggregate deprived customers of $34.1 million even after taking into account the savings from not paying a commission,” the SEC said in a press release. Without admitting or denying the SEC’s findings, Robinhood agreed to pay a $65 million civil penalty.

Robinhood has run into legal issues once again, as its leaders were called to testify to the House Financial Services Committee along with Melvin Capital, Reddit and Citadel on Feb. 18, where accusations of market manipulation were denied and pressing questions were evaded. One particular exchange set the tone for the rest of the hearing.

“You admitted to making mistakes. Specifically what mistakes did you make?” Rep. Madeleine Dean (D-PA) said.

“I admit to always improving. And certainly … we’re not going to be perfect,” Tenev responded.

Moving forward, there will likely be two more hearings related to the GameStop incident, and regulatory changes to financial institutions remain indefinite.

“For years, the same hedge funds, private equity firms and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price,” Sen. Elizabeth Warren (D-MA) said. “It’s long past time for the SEC and other financial regulators to wake up and do their jobs.”