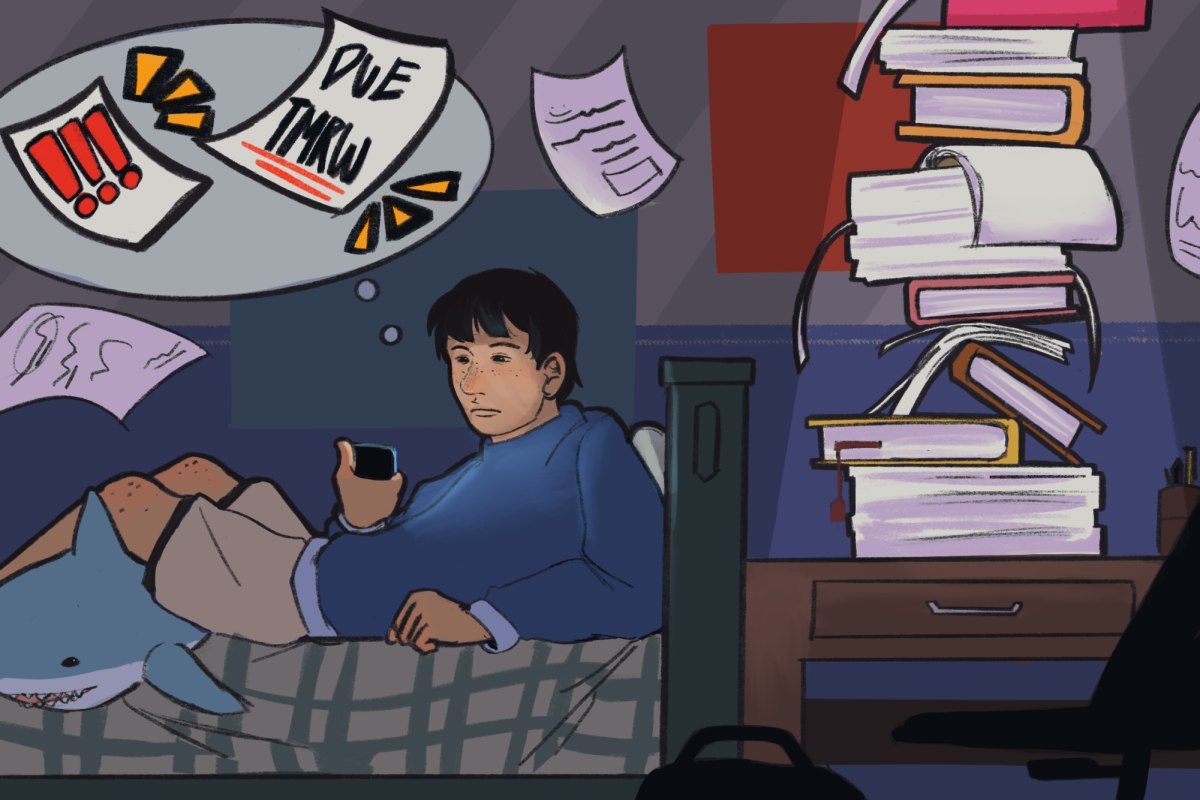

After years of hard work, acceptance letters should be a triumph, not a price tag. Since the average public school costs $11,371 and the average private school costs $44,961 annually, scholarships and financial aid are key to empowering students to reach their highest potential, regardless of income.

Financial aid refers to any monetary assistance, such as scholarships, grants, loans and work study, provided to students. Generally, scholarships and grants do not need to be paid back. Loans are borrowed money that needs to be repaid, and work study is a need-based federal- or state-funded program that provides funds for part-time employment to college students.

“Scholarships can help students graduate with less student debt, which makes a big difference when they go out into the world, get a job and have to start paying bills and managing their own money,” counselor Kate West said. “However, high school students typically don’t think about this when they are taking out loans for college, as the debt won’t start impacting them until after they graduate college.”

Although scholarships set students up for long-term success, there is a common misconception that earning scholarships will hurt students’ chances of getting admitted into a university.

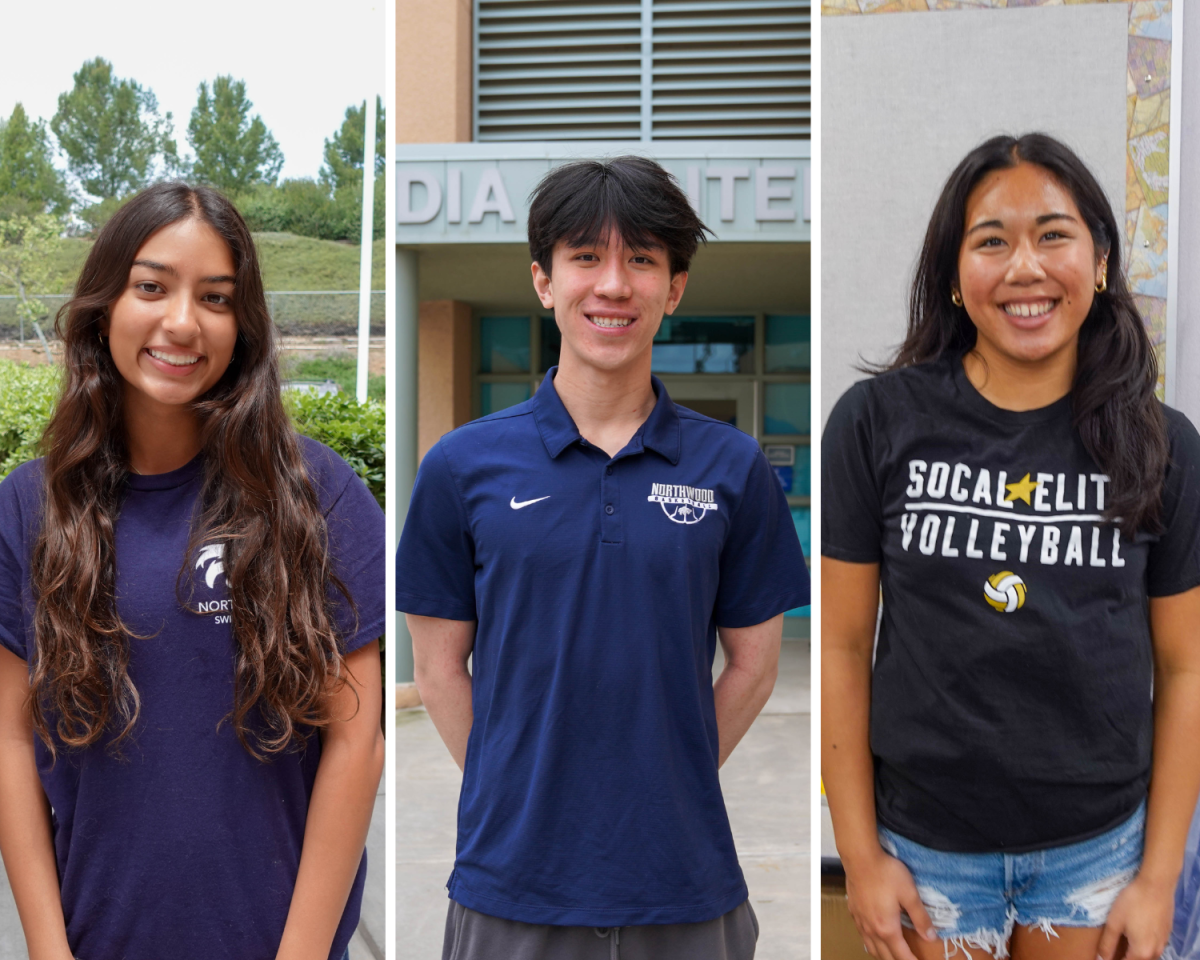

“[Rejection due to financial aid] isn’t typically the case, but it may factor in when looking at pulling students off a waitlist,” West said. “That being said, I would still strongly advocate for students to apply for aid, because you don’t know what you might get.”

In most cases, financial aid does not impact acceptance. Over 100 colleges, including Harvard and Princeton, have “need-blind” policies that require financial aid requests to be considered independent from students’ applications. Another misconception is that aid eligibility is always determined by family income alone.

“Depending on their income bracket, for some families, it may be obvious that they will not qualify,” West said. “But for families who may be on the border, a lot of colleges have raised the caps on income to allow more students and families to qualify for tuition assistance.”

Visit the NHS Counseling page for more information about financial aid and new opportunities. Students can also use the “net price calculator” on a college’s website to estimate how much financial aid they may receive.